By Maureen Aguta

President Bola Tinubu’s approval of a 15 per cent import duty on petrol and diesel has triggered a major shake-up in Nigeria’s downstream oil sector — positioning Dangote Refinery to dominate the market and sidelining traditional fuel importers.

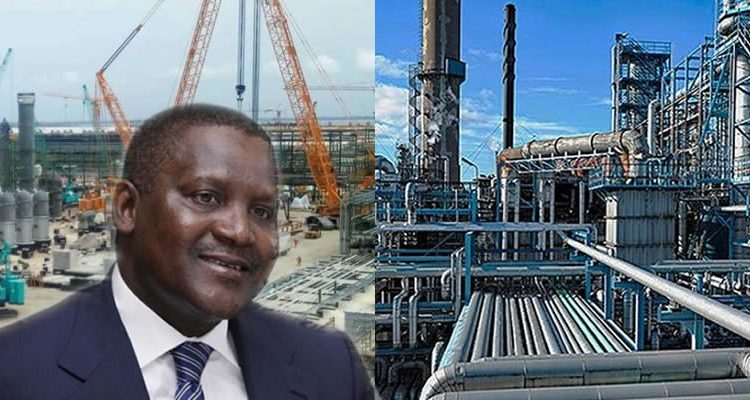

The new ad-valorem tariff, introduced to promote local refining and reduce dependence on imported fuel, effectively raises the cost of imported petroleum products. Analysts say the policy gives Africa’s largest refinery, owned by billionaire Aliko Dangote, a decisive competitive edge.

Policy Favours Local Refiners

With the capacity to process 650,000 barrels of crude daily, the $20 billion Dangote Refinery was designed to make Nigeria self-sufficient in fuel supply. The 15 per cent import duty now acts as a protective wall, ensuring imported petrol and diesel are far costlier than locally refined products.

“The import levy will make it nearly impossible for importers to compete,” said Dr. Wunmi Iledare, an energy economist. “Dangote now enjoys a structural price advantage that secures his dominance in the domestic market.”

Before the tariff, imported petrol often landed at lower prices, challenging Dangote’s market entry. But with the new duty, the landing cost of imported fuel could rise by ₦99 to ₦150 per litre, pushing pump prices above ₦1,000 and giving Dangote room to set the pace for local pricing.

Importers on the Edge

Major importers and marketers, including members of the Major Oil Marketers Association of Nigeria (MOMAN) and the Depot and Petroleum Marketers Association of Nigeria (DAPPMAN), warn the new regime could wipe out independent fuel importation.

“Importing fuel is no longer viable. Everyone will depend on Dangote’s supply,” one marketer said. “The government has effectively handed him control of the market.”

Government Defends Move

Officials insist the import duty is part of the Renewed Hope Agenda to promote energy security and strengthen the naira through local refining.

A senior finance ministry source said: “This isn’t about Dangote. It’s about ending fuel importation, conserving foreign exchange, and building a stable energy base.”

Concerns Over Monopoly and Prices

Economists, however, caution that while the policy may accelerate Nigeria’s path to self-sufficiency, it risks creating a private monopoly that could undermine market competition.

Dr. Aisha Yusuf of Lagos Business School noted: “The government has shifted the pendulum too far. Without checks, one player could dominate pricing and supply.”

Consumers may also feel the pinch in the short term. The expected price hike in petrol and diesel will raise transport and production costs, adding to Nigeria’s inflationary pressures and deepening household hardship.

A New Era in Oil Supply

For now, the 15 per cent duty has redrawn Nigeria’s petroleum landscape. With importers sidelined and Dangote’s refinery at full capacity, the billionaire industrialist appears poised to become the single most powerful force in the country’s downstream oil market — a position that could shape pricing, supply, and energy policy for years to come.